5 Common Mistakes Small Business Owners in UAE Make in Their Bookkeeping

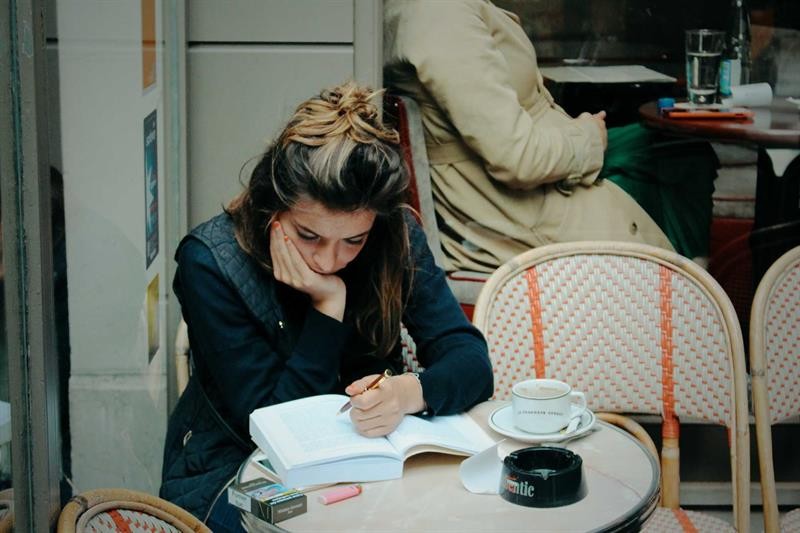

Are you a small business owner trying to do bookkeeping of your company? In this article we will discuss about 5 common mistakes small business owners make while bookkeeping, so that you can avoid them.

If you are an owner of a small-scale business you know the struggles behind juggling matters like sales, marketing, product development, and operations at the same time every day! Due to such a situation, often bookkeeping tends to be kept aside by many. It is a grave mistake to do so. Not thinking about bookkeeping is one of the worst bookkeeping mistakes you can ever make as a small business owner.

For any successful business, good bookkeeping practices are very important. It can give you the best financial insights for you to make smart business decisions, avoid failures and grow your business rapidly.

Unfortunately, most small business owners are not well aware of the need for bookkeeping and how it can be done well. To get started, we would like to draw your attention to the 5 common mistakes small business owners in UAE can make in their bookkeeping.

5 Common Bookkeeping Mistakes Small Businesses Make

Take note of the below-mentioned mistakes and ensure that your business doesn’t end up making one.

1. Records not accurately kept

Keeping accurate records is one of the most critical aspects of bookkeeping. It seems simple but it is often the most overlooked one regarding bookkeeping. Until it’s too late, many small business owners don’t understand the importance of keeping accurate records. For example, many businesses might keep aside tracking expenses or look at the receipts thinking that it can be “done later”. Investing in bookkeeping software will be the worst idea for them because they feel it's unnecessary or very expensive. Truth be told, for the success of your business accurate record-keeping is critical. It can help you make informed decisions, track your progress, and keep you away from making costly mistakes. If records are not kept accurately, you could end up missing out on deductions, overpaying taxes, or making other major mistakes.

Determining who is on staff and who isn’t is also very important. With so many independent consultants, freelancers, and contractors, determining who is who can be very difficult. You might need to face significant consequences, including lawsuits and tax penalties if you have misclassified your contractors and employees.

2. Not being Up-To-Date

Not staying updated is yet another common bookkeeping mistake made by small business owners. ‘Not staying updated’ includes not keeping track of changes in tax regulations and laws and also not recording transactions promptly. You can ensure compliance with all relevant regulations and avoid costly mistakes by recording transactions promptly. The key to effective bookkeeping is communication whether you choose to outsource the work to a professional or hire a part-time bookkeeper to make sure everyone is on the same page and avoid errors. Yet another example of a common mistake is paying a bonus to an employee and not reporting it to the bookkeeper. Another one would be not providing the bookkeeper with relevant receipts while buying supplies.

A fundamental aspect of determining the financial health of your company is by reconciling your books with bank statements. Make sure it’s done consistently and properly. At any given time, if you want to identify how much money you have in hand or to discover bank errors before they become major problems, reconciling your books is a necessity. By hiring an experienced bookkeeper you can take care of the complicated process of reconciliation with ease.

3. Records not organized

Yet another common bookkeeping mistake that small business owners make is not organizing their records properly. This can lead to various bookkeeping errors, duplicate entries, lost receipts, and more.

A few of the simple methods by which you can organize your bookkeeping records are:

- Use of bookkeeping software: By employing bookkeeping software you can avoid bookkeeping mistakes and better track your finances

- Creating a system: Create a system like setting up a designated area for bookkeeping records or creating folders for each month.

- Hire a bookkeeper:

- Consider hiring a bookkeeper if you are not comfortable handling bookkeeping by yourself. You can organize your records and avoid bookkeeping mistakes by employing a bookkeeper.

4. Having no understanding on what to look for

Not knowing what to look for is another common mistake small business owners make. In doing so, you tend to make incorrect assumptions about your business’s finances and also overlook important financial information.

Below given are some of the few things you need to look for when reviewing your bookkeeping records.

- Trends: Includes decreases or increases in profit, expenses, or revenue.

- Red flags: Includes looking out for red flags such as unusual transactions or late payments.

- Opportunities: Includes keeping an eye on opportunities for improving your bookkeeping process or saving money.

If you neglect to track your reimbursable expenses, it would be equal to your money going down the drain. In doing so, you not only lose out on valuable tax deductions but lose money in the process. To make the process of tracking easy and consistent you can employ various expense-tracking apps and programs. Make sure you always have the habit of tracking your expenses as and when it occurs so that you don’t overlook your expenses and damage your company’s financial standing in the long run. Just as important as saving your receipts is tacking reimbursable expenses. Receipts help you maintain a physical track in the event of an audit whereas the other allows you to track the financial health of your business.

5. Deciding on ‘Do it Your Own’

Finally, one of the most common bookkeeping mistakes done by many small business owners is thinking that bookkeeping can be done on their own. While bookkeeping by oneself is not a bad idea, it’s not the best idea. It is easy to make mistakes especially if you don’t have any experience in accounting or bookkeeping.

Hiring the best accounting firms in UAE can save you time and money in the long run. If you have a question about your bookkeeping practices or are looking to improve your financial record keeping, connect with the best audit firms in UAE today!

Related Blog

AC Maintenance Tips from UAE Repair Experts

How to Prepare for the GMAT: A Step-by-Step Guide

68ec9e22634a4.png)

10 Tips for Choosing the Right ERP Solution

Common Problems with CPVC Pipes and How to Avoid Them

The Importance of SAT Practice Tests for SAT Preparation

Common Mistakes to Avoid When Purchasing Air Dryers

Gmat Exam Preparation Tips From Top Tutors In Dubai

Trusted suppliers of pvdf ball valves in uae - what to look for

How Ucat Classes Help Improve Your Cognitive Skills

Electric vs Diesel Compressors: What's Best for UAE Conditions?

Cables For Automotive Industry: What Makes Them Different?

How Ap Chemistry Tutoring In Dubai Boosts Exam Confidence

Top 10 Citizenship by Investment Consultants in the UAE

Benefits Of Using Glass And Aluminium In Modern Construction In Uae

Top Benefits Of Joining Ib Maths Tutoring Classes In Dubai

How To Choose The Right Battery For Your Vehicle In The Uae

How To Choose The Right Cable Manufacturer For Your Business Needs In Uae

Role Of Mock Tests In Gmat Preparation: Insights From Dubai Experts

How to Choose the Best Courier Service for Your Business Needs

Top signs your car battery needs replacement in UAE

Understanding the Different Types of Audit Reports

The Importance Of Cleaning Your Ac Filters: Tips For Better Air Quality

5 Tips to Find the Best Personal Trainer in Dubai

Best Car Repair Shops In Al Quoz

Top Water Meter Suppliers in the UAE

Best SAT Centers in Dubai

Common Causes Of Tyre Damage And How To Avoid Them

Top Cardiology Hospital in Dubai

Top homeopathic clinic in Dubai

Top 5 Flow Meter Suppliers in UAE

Top 5 Pipe Fittings Suppliers in UAE

68edf1fee9090.jpg)

Tips To Minimize Expenses In Your Business

Top 7 Budgeting Tips for International Students in Australia

10 Best Car AC Repair Centers In Dubai

Top 10 dermatology Hospitals in Dubai

Top 10 courier service companies in Abu Dhabi

Top 8 Luxury car service centers in UAE

Common Myths and Misconceptions about IVF Treatment in Dubai

Top 10 Managed IT Service Providers (MSPs) in the USA

Best Car Tyre Brands for Dubai's Road Conditions

10 Best Pirelli Tyre Shops In Dubai

Top 7 Car Tyre Shops In Dubai

Top 5 IVF Clinics in Dubai For Your Journey To Parenthood

KOC Project of Visual Flame Detection Systems

Top 10 Car Repair and Maintenance Services in Dubai

Top 15 Business Setup Consultants in Dubai

Top Ten Car Service Companies In UAE

68f0a0f5a49dc.png)

Top FIT OUT Companies in Dubai

Top 10 Manpower Supplying Companies in UAE

Top 10 GSuite Resellers in Dubai

List of Best Custom Website Development Companies in Dubai

Top 15 Company Formation Consultants in UAE

Top Hyperbaric Oxygen Therapy Centres In UAE

Top Control Room Solutions Providers in UAE

Top 10 accounting and auditing firms in Dubai, UAE

Top 10 Orthopaedic Hospitals in Dubai

UAE's Online Business Listing Directory Websites

Online Learning Platforms for Students

List of Web Designing Companies in Dubai

Study Abroad Destination: How To Choose the Right Country

9 UCAT Exam Tips For Success

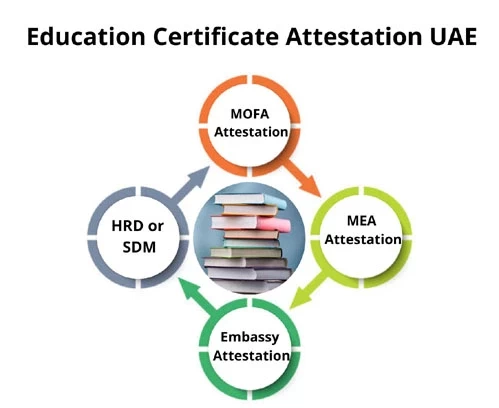

Importance of Educational Certificate Attestation in UAE

Benefits of Implementing Electronic Document Management System

Procedures To Be Fulfilled By A Foreigner To Start A Business In Dubai

What Is The Importance Of Attesting Educational Certificates In UAE?

Deep Cleaning Services in Abu Dhabi

List of e-commerce development companies in Dubai

Top 10 social media marketing agencies in Dubai

Top Water Purifier Brands in UAE